- Posted on

- Bhanu Pratap

At the end of last week, we had an interesting conversation with our team, who reached out to us to discuss financial supply chain management (FSCM). We ended up talking about what FSCM actually is, and we explained a report from upflow showing that 81% of businesses had experienced an increase in delayed payments due to a lack of proper FSCM.

To be honest, we were a bit surprised by this fact. Didn’t these businesses know about FSCM and what it does? But then we thought, maybe not everyone does. So, we decided that it would be helpful to put together a complete overview of FSCM, what it actually does, and why businesses should consider implementing it. Let’s dive into it.

What is FSCM?

First of all, let’s discuss FSCM. The need to streamline financial processes has grown as many businesses have focused more on improving their physical supply chains while overlooking the financial supply chain. This disconnect between systems leads to complications in cash flow and working capital, making the implementation of a comprehensive FSCM system even more important than ever.

Let’s have a look at how business and financial operations have changed since the 1990s and how cash collection procedures have still stuck at the same pace:

| Process | 1990’s | Today |

| Order processing | 4-7 days | Same day |

| Delivery processes | 4-7 days | Same day/next day |

| Invoice processing | 7-10 days | Same day/next day |

| Cash collection | 45-60 days | 45-60 days |

Disclaimer: The information in this table is based on general industry observations and trends over time. It is intended to offer a simplified comparison and may not reflect the exact practices of every business or sector.

The cash collection process should be simple: you send an invoice, and the customer pays it. But with thousands of customers and invoices, errors happen. Incorrect prices, missing details, faulty goods, or customer cash issues can make the process challenging to manage. To reduce this duration, you need SAP FSCM. Let’s see how it does it.

What is SAP FSCM?

SAP FSCM is a set of applications within the SAP ERP system that improves the visibility and control of your accounts receivable. It allows you to manage customer-related financial functions like billing, receivables, collections, and risk assessment, all within the same system.

One of the main benefits of SAP FSCM is that it integrates all these processes and makes them more efficient. It helps you streamline the interaction between systems and teams, which in turn improves cash flow.

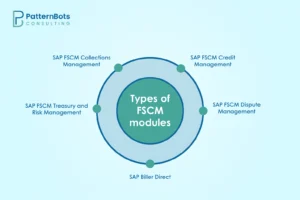

Types of FSCM modules

Now, you should have a basic understanding of SAP FSCM and the operations it manages. However, knowing which modules make these operations possible is important. So let’s take a quick look at FSCM modules and learn more about them.

1. SAP FSCM Credit Management

If you need a SAP system that can assess the credit risks of your company and also monitor the creditworthiness of all the clients, then this module can help you with that. In addition, SAP FSCM Credit Management also helps determine credit limits based on the payment behavior of each customer.

2. SAP FSCM Collections Management

SAP Financials can manage your business’s accounts receivable by creating different collection strategies with this module. Moreover, if you want to monitor the collection performance of your business and automate the follow-up processes, then SAP FSCM Collection Management can help you with that as well.

3. SAP FSCM Treasury and Risk Management

Most businesses are concerned about liquidity management, as forecasting cash flows is not as easy as it seems. That’s when SAP Treasury and Risk Management can help you the most. By optimising cash positions with this module, you can easily manage financial risks and execute the treasury actions of your business.

4. SAP FSCM Dispute Management

With SAP FSCM Dispute Management, you can transparently monitor the customer invoices and billing issues. By tracking and managing the dispute resolution processes, you can improve the cash flow and customer relations of your business.

5. SAP Biller Direct

SAP Biller Direct lets you handle payment and settlement processes with customers or suppliers and also provides integration facilities with accounting systems. With this module, your customers can view their invoices and pay directly through a web-based portal.

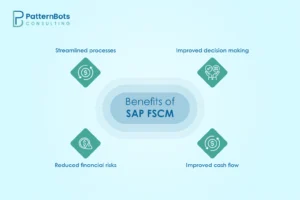

Benefits of SAP FSCM

By using the above-discussed modules of SAP FSCM, you can streamline the overall management of the receivables-related processes. In addition, you can also get benefits like:

1. Improved cash flow

A big reason companies start looking at FSCM is to handle their cash flow in a better way. When you organise how you manage the cash coming in and how much cash is going out, it becomes easier to keep the business moving. That means you can invest where it matters without always needing extra funds.

2. Reduced financial risks

Every business has customers who pay late or sometimes not at all. FSCM gives you tools to assess how risky a customer might be and whether it’s a good idea to extend credit. It helps you take fewer chances with the wrong customers and gives you more confidence when working with the right ones.

3. Streamlined processes

Finance teams often spend time chasing invoices, updating spreadsheets, or trying to keep track of disputes. With FSCM, a lot of that is handled in one place. The tools are designed to make the day-to-day work more structured, so the team can focus on fixing problems rather than just finding them.

4. Improved decision making

The system gives you visibility into how customers are paying, how much they owe, and what your cash situation looks like. With that kind of insight, it’s much easier to plan ahead, make decisions around credit, and get better at forecasting.

How can PatternBots help you with FSCM of your company?

If you’re looking to optimise your financial operations with SAP Financial Supply Chain Management (FSCM), PatternBots is here to support you. Our expert consultancy services are designed to help you identify and implement the right FSCM modules based on your business’s unique financial processes.

With over 15 years of experience in SAP solutions, our SAP FSCM consultants can assist with gap analysis, module selection, and end-to-end FSCM implementation, ensuring a smooth transition to a more efficient and automated financial supply chain. Work with us to improve cash flow visibility and strengthen customer credit management of your business.

Conclusion

So, if you’ve been thinking about how to bring more structure into your financial processes, FSCM is definitely worth a closer look. It helps you stay on top of receivables, manage risks, and improve overall cash flow. Curious about where to begin? Let’s see how PatternBots can help.

Frequently Asked Questions

SAP FSCM is a part of the SAP ERP system that helps streamline financial operations. It connects different areas of SAP Financials to manage receivables, collections, and customer risk more effectively. This makes financial processes smoother and gives better control over the entire financial supply chain.

The SAP FSCM module includes several tools that help with specific financial challenges, like:

- SAP FSCM Credit Management assesses customer credit limits.

- SAP FSCM Collection Management helps manage payments more efficiently.

- SAP FSCM Dispute Management lets you track and resolve invoice issues before they become bigger problems.

- SAP Biller Direct gives customers a self-service portal to view and pay invoices online.

SAP Biller Direct is part of SAP FSCM and focuses on improving customer interaction with invoices. It gives customers access to view bills and pay online through a portal. This makes SAP Financial Management more transparent and user-friendly while supporting smoother payment cycles for businesses.

SAP FSCM Credit Management helps reduce risk by checking a customer’s reliability regarding payments. Built into the SAP ERP system, it pulls data from both inside and outside your business to create smarter SAP Credit Management strategies designed according to your customers or suppliers.

SAP FSCM Collection Management simplifies how you chase outstanding payments. If you’ve worked with SAP FI/CO, you’ll know the follow-up process can be manual. This tool in SAP Financials provides a clear, automated list of who to contact and why, saving time and enhancing collections.